RESON PARTNERS has been continuously

chosen by many foreign affiliates and foreign individuals

due to 1.One-stop bilingual service by Japanese specialists on foreign countries

and 2. High-quality service for reasonable price.

Outsourcing Services

|

By outsourcing all necessary back office operations for doing business in Japan by one-stop RESONE PARTNERS will provide customers with an environment where they can focus more on business.

In cooperation with specialists basing on a partnership agreement, RESONE PARTNERS offers high quality services for reasonable price by its specialists with wide range of expertise in the fields of company establishment, visa acquisition, bookkeeping, payroll calculation, labor, payment agency, accounting and tax etc.

We also have rich experience at providing various services such as fund administration, support for IFRS-based financial reporting to the home country, and management accounting consulting which has been highly evaluated by our customers. |

|

Main handling duties

In addition, by outsourcing the payment operations, our customers will benefit from the viewpoint of internal control by separating authorizers and payers.

Tax and Assurance Services

|

Japan’s tax system is very complicated and taxpayer’s tax burden is heavy when seen from global viewpoint. Therefore, tax planning is very important in doing business in Japan so getting advice from an expert with high expertise in international tax matters also becomes very important.

In addition to the experience and know-how accumulated since 2004, RESON PARTNERS offers high quality tax service by a Japanese/English bilingual Japanese experts having experience of working at Hong Kong and Singapore accounting offices for a reasonable price to foreign individuals or enterprises who plan to develop their business in Japan.

We can also provide various security services such as audits, reviews, AUP (Agreed Upon Procedures), etc. by experts with Certified Public Accountants degree in Japan. |

|

Main handling duties

Tax

In addition, for customers who are required to file a declaration, we will submit a consumption tax, depreciable property tax, business office tax declarations. We also provide monthly declararion for tax withholding that the corporations are obligated to collect and employee year-end adjustment duties.

Assurance

Cross-boarder M&A Services

|

When conducting cross-border M&A you need to understand not only accounting, law, taxation, but also local language, business customs, nationality, etc., which means this is quite a difficult task.

At RESON PARTNERS, we can provide high quality services by experts who are familiar with M&A practice in Japan, and support the whole deal regarding M&A, such as FA (Financial Advisor), due diligence, valuation, PMI (Post Merger Integration), etc.

|

|

Main handling duties

We have a good reputation for services from the viewpoint of anticipation of the share transfer agreement after due diligence, management agreement and value increase (PMI) after acquisiton by experts who understand the whole picture of M & A deal, and regarding the cross-border projects, we also have plenty of correspondence results.

Based on abundant evaluation record in the past, we have received favorable reviews for evaluation services that meet the needs of our customers while minimizing the risk from the accounting and tax viewpoint.

CLIENT ACHIVEMENTSCLIENT ACHIEVEMENTS

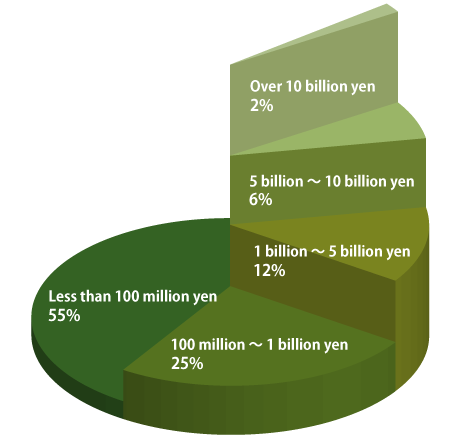

The range of our customers widely range from foreign individuals owning real estate in Japan

to enterprises with sales amount over 10 billion yen.

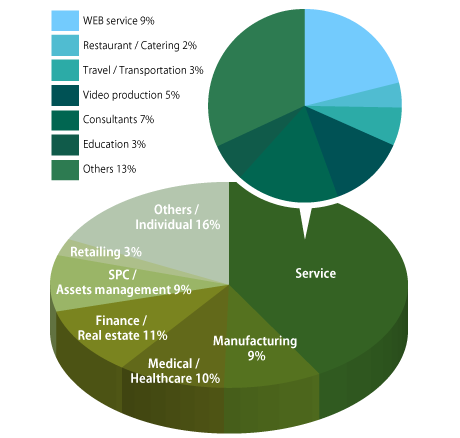

We are dealing with clients from different countries from Asia to North America

and receiving support from global enterprises worldwide, which is our feature.

BY COMPANY SIZE(AMOUNT OF SALES)

|

BY INDUSTRY

|

Total number of clients: 120 (including individual business)

(As of the end of February 2019)